Introduction

The financial performance and market perception of Adani Enterprises have been under significant scrutiny following the release of the Hindenburg report and subsequent allegations. Most recently, the company’s shares witnessed a dramatic decline after the US Securities and Exchange Commission (SEC) filed charges of bribery and fraud against Gautam Adani and other executives on November 20, 2024.

Financial Performance

Net Profit & Total Income:

Adani Enterprises’ financial performance for the quarter ending in November 2024 showed considerable stress, with a sharp decline in share prices. While specific quarterly data is not explicitly mentioned, the impact of recent events on investor sentiment has been severe.

Year-on-Year Comparison:

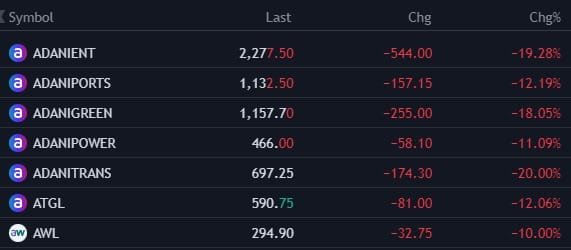

Shares dropped 23% to close at ₹2,182.55, with a significant loss of ₹88,726 crore in market capitalization, reflecting a substantial year-on-year decline in investor confidence.

Reason for Losses:

The adverse financial impact stems from allegations of bribery and fraud, as well as the continued fallout from earlier Hindenburg reports accusing the group of financial misconduct.

News in Brief

The SEC’s charges against Gautam Adani, Sagar Adani, and Cyril Cabanes allege involvement in a massive bribery scheme to secure solar energy contracts. The case claims that more than $250 million in bribes were promised to Indian government officials. These allegations have exacerbated existing market concerns, leading to significant volatility in Adani Enterprises’ share price and a broader ripple effect on the Adani Group’s valuation.

Conclusion

The Adani Group’s troubles, starting from the Hindenburg report in January 2023 to the SEC’s recent bribery allegations, have led to severe financial and reputational setbacks. While the conglomerate continues to deny all accusations, the market response reflects waning investor confidence. This timeline highlights the key developments and their impact on the group’s financial health and public perception.