Introduction:

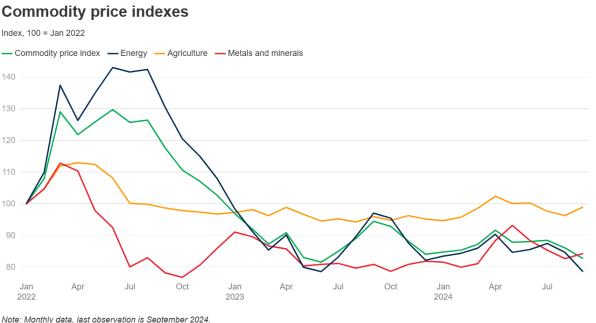

The global commodity market has seen significant fluctuations in recent years. However, recent

projections by the World Bank suggest that commodity prices will experience a notable decline through

2026. This shift is largely driven by changes in global supply and demand dynamics, with a particular

focus on oil prices. The World Bank’s October 2024 Commodity Market Outlook forecasts a drop in

commodity prices, bringing them to their lowest levels since 2020. In this blog, we will delve into the key

projections for commodity prices and their potential economic implications.

Financial Performance:

As we assess the potential decline in commodity prices, it’s crucial to consider how it may impact

companies within the commodity trading, production, and investment sectors. For companies reliant on

high commodity prices—particularly in industries like energy, mining, and agriculture—this price

reduction could significantly affect their revenues and profit margins.

For instance, lower oil prices could benefit industries like manufacturing, logistics, and energy, as it

reduces operational costs. However, firms involved in the extraction or production of raw materials

could face reduced profits due to the lower prices of the commodities they sell.

News in Brief:

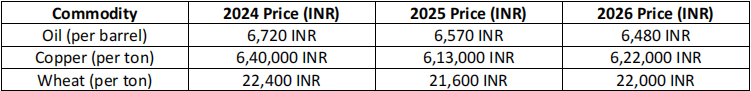

Commodity prices are projected to decline significantly in the coming years, according to the World

Bank’s Commodity Market Outlook report. The outlook predicts a 5% decline in commodity prices in

2025, followed by an additional 2% drop in 2026, driven primarily by a fall in oil prices. The World Bank

suggests that oil prices, which are expected to average INR 6,720 per barrel in 2024, will decline to INR

6,570 per barrel in 2025 and INR 6,480 per barrel in 2026. Along with oil, metals and agricultural

products are expected to see minor price adjustments, though they will remain relatively stable.

Here’s a snapshot of the projected prices for key commodities in INR:

Oil Prices: Forecast to drop from INR 6,720 per barrel in 2024 to INR 6,480 per barrel by 2026.

Copper Prices: Expected to remain stable with minor fluctuations, averaging INR 6,40,000 per ton in

2024, reducing slightly to INR 6,13,000 per ton in 2025, and increasing slightly to INR 6,22,000 per ton in

2026.

Wheat Prices: Projected to decrease from INR 22,400 per ton in 2024 to INR 21,600 per ton in 2025,

before recovering to INR 22,000 per ton in 2026.

Example Chart of Projected Price Movements:

This table clearly highlights the expected decline in oil prices, with copper and wheat prices showing more modest adjustments.

Conclusion:

In conclusion, the World Bank’s projections for a decline in global commodity prices signal a significant

shift in the market, particularly driven by lower oil prices. As this trend unfolds, companies in the

commodity sector will need to adjust their strategies to cope with the stabilizing supply demand

conditions. While the outlook remains cautious for some sectors, lower commodity prices could present

opportunities for businesses positioned to benefit from reduced input costs.

Investors should carefully monitor market trends and the financial performance of companies that are

heavily exposed to commodity prices. By keeping a close watch on these shifts, they can make informed

decisions in navigating the changing commodity landscape over the next few years.